- Excellent Trustpilot Rating of 4.7/5

- Seven Unique Funding Programs

- Five Unique Trading Platform Options

- Professional Trader Dashboard

- A Large Variety of Trading Instruments (Forex Pairs, Commodities, Indices, Cryptocurrencies)

- Leverage up to 1:50

- No Maximum Trading Period

- No Minimum Trading Day Requirements

- Scaling Plan

- First Payout After 10 Days on Classic Challenge & Ultra Challenge

- Future Payouts on a 10-Day Basis

- Default Profit Split of 80%

- Profit Split is Scaleable up to 95%

- Overnight Holding Allowed

- News Trading Allowed During Evaluation (Except on Rapid Challenge)

- Balance-based Drawdown

- News Trading is Prohibited Once Funded

- Weekend Holding is Prohibited (Allowed with Add-on)

- First Payout After 30 Days on Rapid Challenge

- Consistency Rule

Wall Street Funded is a pioneering prop firm established by two seasoned entrepreneurs with extensive experience in the financial sector. Traders have the opportunity to earn substantial profits, with the flexibility to manage account sizes up to $100,000 and receive up to 95% profit splits. This can be accomplished through trading various financial instruments, including forex pairs, commodities, indices, and cryptocurrencies.

Who are Wall Street Funded?

Wall Street Funded is a proprietary trading firm with the legal name WSF TECHNOLOGY – FZCO that was incorporated on the 29th of December, 2023. They are located in Dubai, United Arab Emirates, and are being managed by co-founders Iñaki Martínez and Albert Suriol. Wall Street Funded provides traders with the opportunity to choose between seven account types, two two-step evaluations, one-step evaluation, two instant funding programs, and and two crypto-oriented funding programs, while being partnered with a tier-1 liquidity provider with the best simulated real market trading conditions as their broker.

Wall Street Funded’s headquarters are located at Building A1, Dubai Digital Park, Dubai Silicon Oasis, Dubai, United Arab Emirates.

Who is the CEO of Wall Street Funded?

Iñaki Martínez and Albert Suriol are co-founders of Wall Street Funded.

Iñaki Martínez, the CEO and Co-Founder of Wall Street Funded is recognized as the driving force behind the company’s daily operations. Known for his exceptional leadership and deep expertise in the financial sector, he brings a passionate commitment to innovation and excellence. His vision centers on creating a sustainable, success-oriented environment that empowers traders to reach their full potential.

As the Executive President and Co-Founder, Albert Suriol serves as Wall Street Funded’s strategic guide. With a distinguished career in finance, he provides the company with an invaluable depth of knowledge and a forward-looking perspective that helps position Wall Street Funded as a competitive leader in the proprietary trading industry.

Video Review

Funding Program Options

Wall Street Funded provides its traders with seven unique funding program options:

- Classic Challenge

- Ultra Challenge

- Rapid Challenge

- Instant Standard

- Instant Pro

- One-Step Crypto

- Two-Step Crypto

Classic Challenge

Wall Street Funded’s Classic Challenge provides traders the opportunity to manage account sizes ranging from $5,000 up to $100,000. The aim is to identify talented traders who are profitable and can efficiently manage risk throughout the two-step evaluation period. The Classic Challenge allows you to trade with up to 1:50 leverage.

| Account Size | Price |

|---|---|

| $5,000 | $89 |

| $10,000 | $119 |

| $25,000 | $259 |

| $50,000 | $367 |

| $100,000 | $579 |

Evaluation phase one requires a trader to reach a profit target of 8% while not surpassing their 5% maximum daily loss or 8% maximum loss rules. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase one. To proceed to phase two, you are only required to reach the 8% profit target without breaching the maximum daily or maximum loss limit rules.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 8% maximum loss rules. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase two. To proceed to funded status, you are only required to reach the 5% profit target without breaching the maximum daily or maximum loss limit rules.

By completing both evaluation phases, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 5% maximum daily loss and 8% maximum loss rules. Your first payout on your funded account is after 10 calendar days, while all other withdrawals can also be submitted on a 10-day basis. Your profit split will be 80% up to 95% based on the profit you make on your funded account.

Add-ons for Wall Street Funded’s Classic Challenge

- 90% Profit Split

- Allowed Weekend Holding

Classic Challenge Scaling Plan

Classic Challenge also has a scaling plan. If a trader is profitable with an average return of 15% and at least 3 successful withdrawals over the three-month period, then you will become eligible for an account size increase equal to 25% of the initial account size. The profit split can also be increased up to 95% through the scaling plan. The first time you successfully qualify for scaling, your profit split rises to 90%, while once you successfully qualify for scaling the second time, your profit split increases to a final 95%.

Example:

After 3 Months: A qualified $100,000 account increases to $125,000.

After the Next 3 Months: A qualified $125,000 account increases to $150,000.

After the Next 3 Months: A qualified $150,000 account increases to $175,000.

And so on…

Classic Challenge Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 8%, whereas Phase 2 requires reaching a profit target of 5%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 8%.

- No News Trading Once Funded – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 4-minute period both before and after the announcement of particular news. (Only on funded accounts)

- No Weekend Holding – Traders are prohibited from holding trades during the weekend, meaning that all trades should be closed before the Friday market close. (Allowed with Add-on)

Ultra Challenge

Wall Street Funded’s Ultra Challenge provides traders the opportunity to manage account sizes ranging from $10,000 up to $100,000. The aim is to identify talented traders who are profitable and can efficiently manage risk throughout the two-step evaluation period. The Ultra Challenge allows you to trade with up to 1:50 leverage.

| Account Size | Price |

|---|---|

| $10,000 | $109 |

| $25,000 | $209 |

| $50,000 | $349 |

| $100,000 | $509 |

Evaluation phase one requires a trader to reach a profit target of 10% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase one. To proceed to phase two, you are only required to reach the 10% profit target without breaching the maximum daily or maximum loss limit rules.

Evaluation phase two requires a trader to reach a profit target of 5% while not surpassing their 5% maximum daily loss or 10% maximum loss rules. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase two. To proceed to funded status, you are only required to reach the 5% profit target without breaching the maximum daily or maximum loss limit rules.

By completing both evaluation phases, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 5% maximum daily loss and 10% maximum loss rules. Your first payout on your funded account is after 10 calendar days, while all other withdrawals can also be submitted on a 10-day basis. Your profit split will be 80% up to 95% based on the profit you make on your funded account.

Add-ons for Wall Street Funded’s Ultra Challenge

- 90% Profit Split

- Allowed Weekend Holding

Ultra Challenge Scaling Plan

Ultra Challenge also has a scaling plan. If a trader is profitable with an average return of 15% and at least 3 successful withdrawals over the three-month period, then you will become eligible for an account size increase equal to 25% of the initial account size. The profit split can also be increased up to 95% through the scaling plan. The first time you successfully qualify for scaling, your profit split rises to 90%, while once you successfully qualify for scaling the second time, your profit split increases to a final 95%.

Example:

After 3 Months: A qualified $100,000 account increases to $125,000.

After the Next 3 Months: A qualified $125,000 account increases to $150,000.

After the Next 3 Months: A qualified $150,000 account increases to $175,000.

And so on…

Ultra Challenge Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for Phase 1 is set at 10%, whereas Phase 2 requires reaching a profit target of 5%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 5%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 10%.

- No News Trading Once Funded – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 4-minute period both before and after the announcement of particular news. (Only on funded accounts)

- No Weekend Holding – Traders are prohibited from holding trades during the weekend, meaning that all trades should be closed before the Friday market close. (Allowed with Add-on)

Rapid Challenge

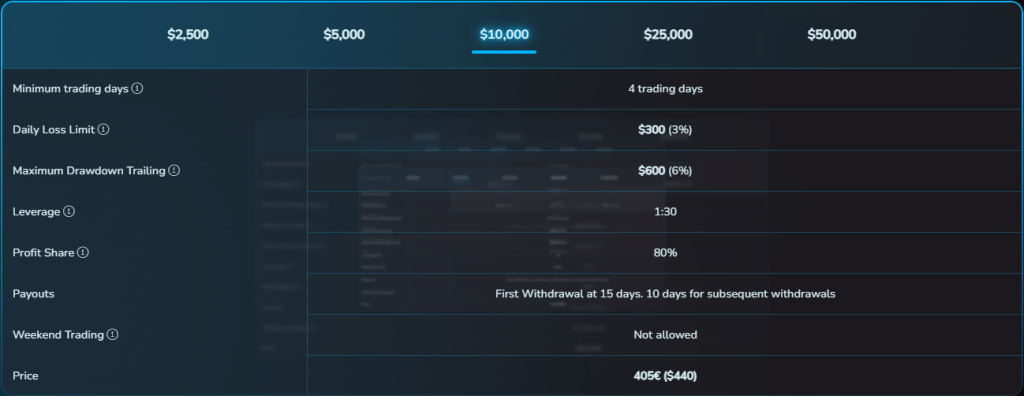

Wall Street Funded’s Rapid Challenge provides traders with the opportunity to manage account sizes ranging from $10,000 up to $100,000. The aim is to identify disciplined traders who are profitable and can efficiently manage risk throughout a one-step evaluation period. The Rapid Challenge allows you to trade with leverage up to 1:30.

| Account Size | Price |

|---|---|

| $10,000 | $119 |

| $25,000 | $259 |

| $50,000 | $379 |

| $100,000 | $589 |

The evaluation phase requires a trader to reach a profit target of 10% while not surpassing their 4% maximum daily loss or 6% maximum loss rules. When it comes to time limitations, note that you have no minimum or maximum trading day requirements during phase one. To proceed to funded status, you are only required to reach the 10% profit target without breaching the maximum daily or maximum loss limit rules.

By completing the evaluation phase, you are awarded a funded account with no minimum withdrawal requirements. You must only respect the 4% maximum daily loss and 6% maximum loss rules. Your first payout on your funded account is after 30 calendar days, while all other withdrawals can be submitted on a 10-day basis. Your profit split will be 80% up to 95% based on the profit you make on your funded account.

Add-ons for Wall Street Funded’s Rapid Challenge

- 90% Profit Split

- Allowed Weekend Holding

Rapid Challenge Scaling Plan

Rapid Challenge also has a scaling plan. If a trader is profitable with an average return of 15% and at least 3 successful withdrawals over the three-month period, then you will become eligible for an account size increase equal to 25% of the initial account size. The profit split can also be increased up to 95% through the scaling plan. The first time you successfully qualify for scaling, your profit split rises to 90%, while once you successfully qualify for scaling the second time, your profit split increases to a final 95%.

Example:

After 3 Months: A qualified $100,000 account increases to $125,000.

After the Next 3 Months: A qualified $125,000 account increases to $150,000.

After the Next 3 Months: A qualified $150,000 account increases to $175,000.

And so on…

Rapid Challenge Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account. The profit target for the evaluation phase is 10%. Funded accounts do not have any specified profit targets.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 4%.

- Maximum Loss – The maximum loss limit a trader is allowed to lose overall without breaching the account. All account sizes have a maximum loss of 6%.

- No News Trading Once Funded – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 4-minute period both before and after the announcement of particular news. (Only on funded accounts)

- No Weekend Holding – Traders are prohibited from holding trades during the weekend, meaning that all trades should be closed before the Friday market close. (Allowed with Add-on)

Instant Standard

Wall Street Funded’s Instant Standard provides traders the opportunity to manage account sizes ranging from $2,500 up to $50,000. The aim is to allow traders to skip the evaluation altogether and start earning from the start. The Instant Funding X allows you to trade with up to 1:30 leverage.

| Account Size | Price |

|---|---|

| $2,500 | $90 |

| $5,000 | $225 |

| $10,000 | $440 |

| $25,000 | $800 |

| $50,000 | $1800 |

By purchasing Instant Standard, you are awarded a funded account where you have no minimum withdrawal. You must only respect the 3% maximum daily and 6% maximum trailing loss rules, maximum loss per trade idea of 1%, and a consistency rule of 30%. Your first payout can be at 15 calendar days, while all other withdrawals can be submitted every 10 days. Your profit split will be 80% up to 95% based on the profit you make on your funded account.

Instant Standard Scaling Plan

Instant Standard also has a scaling plan. If a trader is profitable with an average return of 15% and at least 3 successful withdrawals over the three-month period, then you will become eligible for an account size increase equal to 25% of the initial account size. The profit split can also be increased up to 95% through the scaling plan. The first time you successfully qualify for scaling, your profit split rises to 90%, while once you successfully qualify for scaling the second time, your profit split increases to a final 95%.

Example:

After 3 Months: A qualified $100,000 account increases to $125,000.

After the Next 3 Months: A qualified $125,000 account increases to $150,000.

After the Next 3 Months: A qualified $150,000 account increases to $175,000.

And so on…

Instant Standard Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 3%.

- Maximum Trailing Loss – The difference between the highest achieved account balance and the lowest point of the drawdown determines the maximum trailing loss a trader is allowed to lose without breaching the account. All account sizes have a maximum trailing loss of 6%. Trailing loss locks as it reaches the initial account balance.

- Minimum Trading Days – The minimum profitable trading day requirement you must meet before you can successfully conclude an evaluation phase. You have a 4 minimum profitable trading day requirement of a minimum profit of 0.5% of the initial balance.

- No Weekend Holding – Traders are prohibited from holding trades during the weekend, meaning that all trades should be closed before the Friday market close. (Allowed with Add-on)

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 4-minute period both before and after the announcement of particular news.

- Consistency Rule – Mandates traders to maintain uniformity in various aspects such as position sizes, risk management, losses, gains, and more. This implies that the account results should not exhibit significant variations in their characteristics. The consistency rule ensures that no single trading day accounts for more than 30% of total profits.

- Stop Loss Rule – All trades executed during high-impact news events must have pre-defined Stop Loss (SL) and Take Profit (TP) at the time the trade is opened.

Instant Pro

Wall Street Funded’s Instant Pro provides traders the opportunity to manage account sizes ranging from $2,500 up to $100,000. The aim is to allow traders to skip the evaluation altogether and start earning from the start. The Instant Funding X allows you to trade with up to 1:30 leverage.

| Account Size | Price |

|---|---|

| $2,500 | $60 |

| $5,000 | $85 |

| $10,000 | $115 |

| $25,000 | $232 |

| $50,000 | $345 |

| $100,000 | $562 |

By purchasing Instant Pro, you are awarded a funded account where you have no minimum withdrawal. You must only respect the 3% maximum daily and 5% maximum trailing loss rules, maximum loss per trade idea of 1%, and a consistency rule of 15%. Your first payout can be at 15 calendar days, while all other withdrawals can be submitted every 10 days. Your profit split will be 80% up to 95% based on the profit you make on your funded account.

Instant Pro Scaling Plan

Instant Pro also has a scaling plan. If a trader is profitable with an average return of 15% and at least 3 successful withdrawals over the three-month period, then you will become eligible for an account size increase equal to 25% of the initial account size. The profit split can also be increased up to 95% through the scaling plan. The first time you successfully qualify for scaling, your profit split rises to 90%, while once you successfully qualify for scaling the second time, your profit split increases to a final 95%.

Example:

After 3 Months: A qualified $100,000 account increases to $125,000.

After the Next 3 Months: A qualified $125,000 account increases to $150,000.

After the Next 3 Months: A qualified $150,000 account increases to $175,000.

And so on…

Instant Pro Trading Rules & Objectives

- Profit Target – Traders must achieve a designated profit percentage to successfully conclude an evaluation phase, withdraw earnings, or scale their trading account.

- Maximum Daily Loss – The maximum loss limit a trader is allowed to lose in a single trading day without breaching the account. All account sizes have a maximum daily loss of 3%.

- Maximum Trailing Loss – The difference between the highest achieved account balance and the lowest point of the drawdown determines the maximum trailing loss a trader is allowed to lose without breaching the account. All account sizes have a maximum trailing loss of 5%. Trailing loss locks as it reaches the initial account balance.

- Minimum Trading Days – The minimum profitable trading day requirement you must meet before you can successfully conclude an evaluation phase. You have a 4 minimum profitable trading day requirement of a minimum profit of 0.5% of the initial balance.

- No Weekend Holding – Traders are prohibited from holding trades during the weekend, meaning that all trades should be closed before the Friday market close. (Allowed with Add-on)

- No News Trading – Trading is not permitted during high-impact news releases. This implies that executing new trades or closing existing trades on the specified instrument is prohibited within the 4-minute period both before and after the announcement of particular news.

- Consistency Rule – Mandates traders to maintain uniformity in various aspects such as position sizes, risk management, losses, gains, and more. This implies that the account results should not exhibit significant variations in their characteristics. The consistency rule ensures that no single trading day accounts for more than 15% of total profits.

- Stop Loss Rule – All trades executed during high-impact news events must have pre-defined Stop Loss (SL) and Take Profit (TP) at the time the trade is opened.

Other Funding Program Types

Learn more about the One-step Crypto Evaluation and the Two-step Crypto Evaluation.

What Makes Wall Street Funded Different From Other Prop Firms?

Wall Street Funded differs from most industry-leading prop firms due to offering seven unique account types: two two-step evaluations and one-step evaluation, two instant funding program and two crypto-oriented funding programs. In addition, they also provide numerous favorable features, such as an unlimited trading period, no minimum trading day requirements (except instant funding programs), add-on features, five unique trading platform choices, first withdrawal after 10 calendar days (except Rapid Challenge), and futures withdrawals on a 10-day basis.

Wall Street Funded’s Classic Challenge is a two-step evaluation that requires traders to successfully complete two phases before becoming eligible for payouts. The profit target is 8% in phase one and 5% in phase two, with a 5% maximum daily and 8% maximum loss rules. You also have no minimum or maximum trading day requirements during both evaluation phases. The Classic Challenge also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Classic Challenge stands out mainly for having an unlimited trading period, no minimum trading day requirements, add-on features, first withdrawal after 10 calendar days, and futures withdrawals on a 10-day basis.

Example of comparison between Wall Street Funded & E8 Markets

| Trading Objectives | Wall Street Funded | E8 Markets |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 4% |

| Maximum Daily Loss | 5% | 4% |

| Maximum Loss | 8% | 8% (Scaleable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 95% | 80% |

Example of comparison between Wall Street Funded & Fintokei

| Trading Objectives | Wall Street Funded | Fintokei |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 95% | 80% up to 95% |

Example of comparison between Wall Street Funded & FundedNext

| Trading Objectives | Wall Street Funded | FundedNext (Stellar) |

|---|---|---|

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 8% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 95% | 80% up to 95% |

Wall Street Funded’s Ultra Challenge is a two-step evaluation that requires traders to successfully complete two phases before becoming eligible for payouts. The profit target is 10% in phase one and 5% in phase two, with a 5% maximum daily and 10% maximum loss rules. You also have no minimum or maximum trading day requirements during both evaluation phases. The Ultra Challenge also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Ultra Challenge stands out mainly for having an unlimited trading period, no minimum trading day requirements, add-on features, first withdrawal after 10 calendar days, and futures withdrawals on a 10-day basis.

Example of comparison between Wall Street Funded & Funding Pips

| Trading Objectives | Wall Street Funded | Funding Pips |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% (Scaleable up to 7%) |

| Maximum Loss | 10% | 10% (Scaleable up to 14%) |

| Minimum Trading Days | No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 95% | 60% up to 100% + Monthly Salary |

Example of comparison between Wall Street Funded & FXIFY

| Trading Objectives | Wall Street Funded | FXIFY |

|---|---|---|

| Phase 1 Profit Target | 10% | 10% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 5 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 95% | 80% up to 90% |

Example of comparison between Wall Street Funded & Alpha Capital Group

| Trading Objectives | Wall Street Funded | Alpha Capital Group |

|---|---|---|

| Phase 1 Profit Target | 10% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum Daily Loss | 5% | 5% |

| Maximum Loss | 10% | 10% |

| Minimum Trading Days | No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Phase 1: Unlimited Phase 2: Unlimited | Phase 1: Unlimited Phase 2: Unlimited |

| Profit Split | 80% up to 95% | 80% |

Wall Street Funded’s Rapid Challenge is a one-step evaluation that requires traders to successfully complete a single phase before becoming eligible for payouts. The profit target is 10%, with a 4% maximum daily and 6% maximum loss rules. You also have no minimum or maximum trading day requirements during the evaluation phase. Keep in mind that the Rapid Challenge also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Rapid Challenge stands out mainly for having an unlimited trading period, no minimum trading day requirements, add-on features, and futures withdrawals on a 10-day basis.

Example of comparison between Wall Street Funded & Funded Trading Plus

| Trading Objectives | Wall Street Funded | Funded Trading Plus |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 6% | 6% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 80% up to 100% |

Example of comparison between Wall Street Funded & Goat Funded Trader

| Trading Objectives | Wall Street Funded | Goat Funded Trader |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 6% | 6% |

| Minimum Trading Days | No Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 75% up to 95% |

Example of comparison between Wall Street Funded & Blue Guardian

| Trading Objectives | Wall Street Funded | Blue Guardian |

|---|---|---|

| Profit Target | 10% | 10% |

| Maximum Daily Loss | 4% | 4% |

| Maximum Loss | 6% | 6% (Trailing) |

| Minimum Trading Days | No Minimum Trading Days | 3 Calendar Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 85% |

Wall Street Funded’s Instant Standard is a direct funding account that allows traders to skip the evaluation altogether and start earning from the start. There is no minimum withdrawal requirement, with a 3% maximum daily and 6% maximum trailing loss rules. When it comes to time limitations, note that you have no maximum trading day requirements during phase two. However, you are required to trade a minimum of four trading days. Additionally, you must adhere to a consistency rule of 30% and maintain a maximum loss per trade of 1%. Keep in mind that Instant Funding Standard also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Instant Standard stands out mainly for having an unlimited trading period numerous trading platform options, unique scaling plan, and futures withdrawals on a 10-day basis.

Example of comparison between Wall Street Funded & City Traders Imperium

| Trading Objectives | Wall Street Funded | City Traders Imperium |

|---|---|---|

| Profit Target | ❌ | 10% |

| Maximum Daily Loss | 3% | ❌ |

| Maximum Loss | 6% (Trailing) | 6% |

| Minimum Trading Days | 4 Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 50% up to 100% + Monthly Salary |

Example of comparison between Wall Street Funded & OFP

| Trading Objectives | Wall Street Funded | OFP |

|---|---|---|

| Profit Target | ❌ | ❌ |

| Maximum Daily Loss | 3% | 3%, 4%, or 5% |

| Maximum Loss | 6% (Trailing) | 6%, 8%, or 10% (Trailing) |

| Minimum Trading Days | 4 Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 26% up to 95% |

Example of comparison between Wall Street Funded & Tradexprop

| Trading Objectives | Wall Street Funded | Tradexprop |

|---|---|---|

| Profit Target | ❌ | ❌ |

| Maximum Daily Loss | 3% | 5% |

| Maximum Loss | 6% (Trailing) | 5% |

| Minimum Trading Days | 4 Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 80% (90% with Add-on) |

Wall Street Funded’s Instant Pro is a direct funding account that allows traders to skip the evaluation altogether and start earning from the start. There is no minimum withdrawal requirement, with a 3% maximum daily and 5% maximum trailing loss rules. When it comes to time limitations, note that you have no maximum trading day requirements during phase two. However, you are required to trade a minimum of four trading days. Additionally, you must adhere to a consistency rule of 30% and maintain a maximum loss per trade of 1%. Keep in mind that Instant Funding Pro also has a unique scaling plan, allowing traders to manage even larger account sizes. Compared to other funding programs within the industry, the Instant Pro stands out mainly for having an unlimited trading period numerous trading platform options, unique scaling plan, and futures withdrawals on a 10-day basis.

Example of comparison between Wall Street Funded & The5%ers

| Trading Objectives | Wall Street Funded | The5%ers (Hyper Growth) |

|---|---|---|

| Profit Target | ❌ | 10% |

| Maximum Daily Loss | 3% | 3% (Daily Pause) |

| Maximum Loss | 5% (Trailing) | 6% |

| Minimum Trading Days | 4 Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 50% up to 100% |

Example of comparison between Wall Street Funded & The5%ers

| Trading Objectives | Wall Street Funded | The5%ers (Hyper Growth) |

|---|---|---|

| Profit Target | ❌ | 10% |

| Maximum Daily Loss | 3% | 3% (Daily Pause) |

| Maximum Loss | 5% (Trailing) | 6% |

| Minimum Trading Days | 4 Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 50% up to 100% |

Example of comparison between Wall Street Funded & The5%ers

| Trading Objectives | Wall Street Funded | The5%ers (Hyper Growth) |

|---|---|---|

| Profit Target | ❌ | 10% |

| Maximum Daily Loss | 3% | 3% (Daily Pause) |

| Maximum Loss | 5% (Trailing) | 6% |

| Minimum Trading Days | 4 Minimum Trading Days | No Minimum Trading Days |

| Maximum Trading Period | Unlimited | Unlimited |

| Profit Split | 80% up to 95% | 50% up to 100% |

In conclusion, Wall Street Funded differs from other industry-leading prop firms by offering seven account types: two two-step evaluations and a one-step evaluation, two instant programs, and two crypto-oriented funding programs. In addition, they also provide numerous favorable features, such as an unlimited trading period, no minimum trading day requirements, add-on features, five unique trading platform choices, first withdrawal after 10 calendar days (except Rapid Challenge), and futures withdrawals on a 10-day basis.

Is Getting Wall Street Funded Capital Realistic?

It is essential to evaluate the achievability of trading requirements when considering proprietary trading firms that align with your forex trading style. While a company may appear attractive with a high percentage profit split on a generously funded account, the practicality decreases if they demand substantial monthly gains with minimal maximum drawdown percentages, significantly reducing the likelihood of success. Additionally, examining time constraints is crucial, with an unlimited trading period being more advantageous as it eliminates the pressure associated with time constraints. Lastly, it is essential to acquaint yourself with all trading rules during the evaluation process and subsequent funding stages to mitigate the risk of accidentally violating your trading account terms.

- Receiving capital from the Classic Challenge is realistic primarily due to its below-average profit targets (8% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 8% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly in a day or proceed at your preferred trading pace. Furthermore, upon successfully completing both evaluation phases, participants qualify for payouts featuring an advantageous profit split of 80% up to 95%.

- Receiving capital from the Ultra Challenge is realistic primarily due to its average profit targets (10% in phase one and 5% in phase two) coupled with average maximum loss rules (5% maximum daily and 10% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly in a day or proceed at your preferred trading pace. Furthermore, upon successfully completing both evaluation phases, participants qualify for payouts featuring an advantageous profit split of 80% up to 95%.

- Receiving capital from the Rapid Challenge is realistic primarily due to its average profit target of 10% coupled with average maximum loss rules (4% maximum daily and 6% maximum loss). It is important to note that there are no minimum or maximum trading day requirements, offering flexibility without time constraints, meaning that you can secure funding swiftly in a day or proceed at your preferred trading pace. Furthermore, upon successfully completing the evaluation phase, participants qualify for payouts featuring an advantageous profit split of 80% up to 95%.

- Receiving capital from Instant Standard is realistic primarily due to the average maximum loss rule (3% maximum daily loss and 6% maximum trailing loss). It is important to note that there are no maximum trading day requirements while having a minimum trading day requirement of 4 calendar days. Furthermore, upon successfully generating a profits, participants qualify for payouts featuring an advantageous profit split of 80%, up to 95%.

- Receiving capital from Instant Pro is realistic primarily due to the average maximum loss rule (3% maximum daily loss and 5% maximum trailing loss). It is important to note that there are no maximum trading day requirements while having a minimum trading day requirement of 4 calendar days. Furthermore, upon successfully generating a profits, participants qualify for payouts featuring an advantageous profit split of 80%, up to 95%.

After considering all the factors, Wall Street Funded is highly recommended since you have seven unique funding programs to choose from, two two-step evaluations, a one-step evaluation, two instant funding programs and and two crypto-oriented funding programs, which all feature realistic trading objectives and conditions for qualifying for payouts.

Payment Proof

Wall Street Funded is a proprietary trading firm that was incorporated on the 29th of December, 2023. They have a large community of traders who have reached funded status and successfully qualify for a profit split.

While working with Wall Street Funded and reaching funded status with the Classic Challenge or Ultra Challenge, you will be eligible to receive your first payout after 10 calendar days. However, after your first payout, you will also be eligible to receive payouts if you exceed the initial account size every 10 calendar days. Your profit split will consist of a generous 80% up to 95% based on the profit that you have generated on your funded account.

However, while working with Wall Street Funded and reaching funded status with the Rapid Challenge, you will be eligible to receive your first payout after 30 calendar days. However, after your first payout, you will be eligible to receive payouts if you exceed the initial account size every 10 calendar days. Your profit split will consist of a generous 80% up to 95% based on the profit that you have generated on your funded account.

While working with Wall Street Funded and reaching funded status with the Instant Standard or Instant Pro, you will be eligible to receive your first payout after 15 calendar days. However, after your first payout, you will also be eligible to receive payouts if you exceed the initial account size every 10 calendar days. Your profit split will consist of a generous 80% up to 95% based on the profit that you have generated on your funded account.

When it comes to Wall Street Funded payment proof, you can find it on numerous websites. One example is Trustpilot, where their traders comment regarding their experience while working with the company as well as the process of how they successfully received payouts. Another source of payment proof for Wall Street Funded is their Discord channel, where you can find numerous payout certificates of the most successful traders.

Examples of Payout Certificates and Payment Proof can be seen in the images below.

Which Broker Does Wall Street Funded Use?

Wall Street Funded is partnered with a tier-1 liquidity provider with the best simulated real market trading conditions as their broker.

As for trading platforms, while you are working with Wall Street Funded, they allow you to trade on MetaTrader 5, DXtrade, Match-Trader, and cTrader.

Trading Instruments

As mentioned above, Wall Street Funded is partnered with a tier-1 liquidity provider with the best simulated real market trading conditions, and they allow you to trade a wide range of trading instruments, which include forex pairs, commodities, indices, and cryptocurrencies with a leverage of up to 1:50, depending on the funding program and the trading instruments that you are trading.

Forex Pairs

| AUD/CAD | AUD/CHF | AUD/JPY | AUD/NZD | AUD/SGD | AUD/USD |

| AUD/ZAR | CAD/CHF | CAD/JPY | CHF/HUF | CHF/JPY | CHF/ZAR |

| EUR/AUD | EUR/CAD | EUR/CHF | EUR/CZK | EUR/GBP | EUR/HUF |

| EUR/JPY | EUR/MXN | EUR/NOK | EUR/NZD | EUR/PLN | EUR/SEK |

| EUR/SGD | EUR/USD | EUR/ZAR | GBP/AUD | GBP/CAD | GBP/CHF |

| GBP/JPY | GBP/NZD | GBP/SGD | GBP/USD | GBP/ZAR | NOK/SEK |

| NZD/CAD | NZD/CHF | NZD/JPY | NZD/SEK | NZD/SGD | NZD/USD |

| SGD/JPY | USD/CAD | USD/CHF | USD/CZK | USD/HUF | USD/ILS |

| USD/JPY | USD/MXN | USD/NOK | USD/PLN | USD/SEK | USD/SGD |

| USD/ZAR | ZAR/JPY |

Commodities

| BRENT | CL | NGAS | XAG/USD | XAU/USD |

| XPD/USD | XPT/USD |

Indices

| DAX | DOW | FTSE | HK50 | NIKKEI |

| NSDQ | SP | STOXX50 | ASX | CAC |

Cryptocurrencies

| BCH/USD | BTC/USD | ETH/USD | LTC/USD |

Trading Platform Symbols

Trading Fees

Trading Commission

| Trading Instrument | Commission Fee |

|---|---|

| FOREX | 4 USD / LOT (7 USD / LOT on DXtrade) |

| COMMODITIES | 4 USD / LOT (Only Metals on Match-Trader)(7 USD / LOT on DXtrade) |

| INDICES | 0 USD / LOT (7 USD / LOT on DXtrade) |

| CRYPTO | 0 USD / LOT (7 USD / LOT on DXtrade) |

Spread Account

To check the live spreads, log in to the trading account below.

| Platform | Server | Login Number | Password | Download Platform |

|---|---|---|---|---|

| MetaTrader 5 | InterTrader- MT5 Live | 512654 | r3N&RFq_R+2 | Click here |

| DXtrade | – | wsf_C0020287 | r3N&RFq_R+2 | Click here |

| Match-Trader | – | [email protected] | r3N&RFq_R+2 | Click here |

| cTrader | – | [email protected] | WSFunded@123 | Click here |

Education

Wall Street Funded currently doesn’t provide any additional educational content to their community. However, they are working on a detailed Video section within their Trading Dashboard, which will include their very own video tutorials for their community.

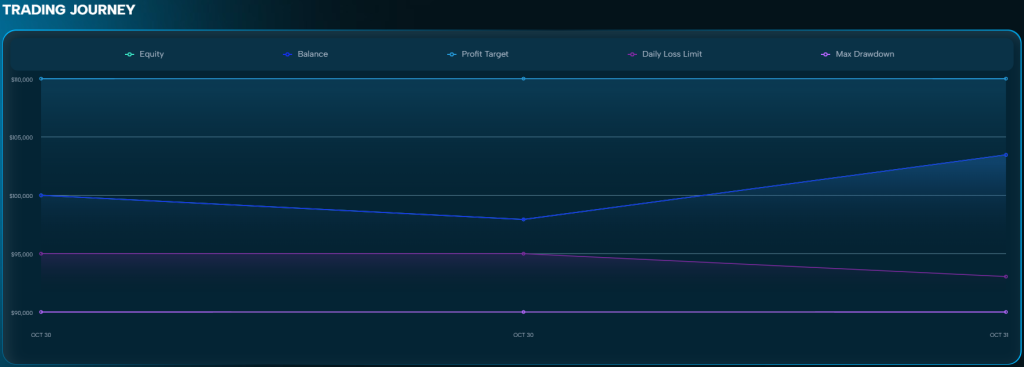

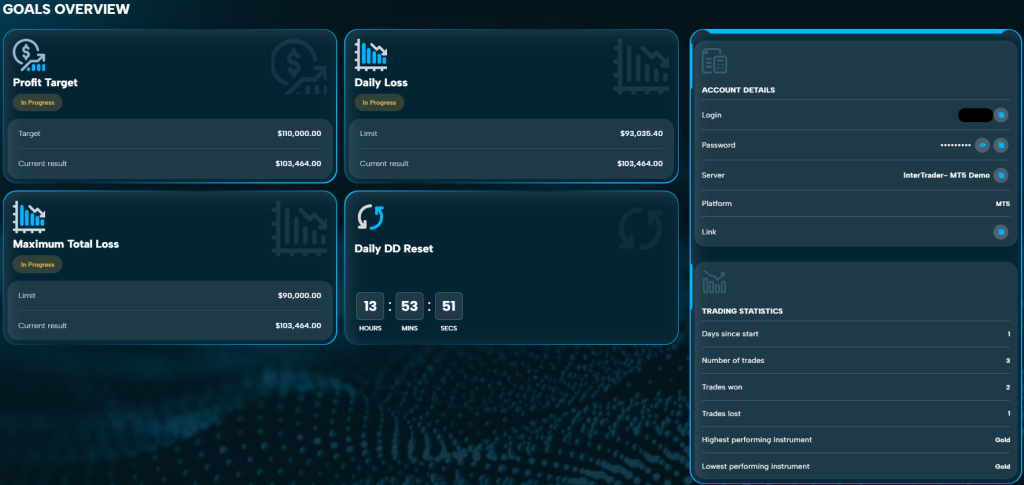

Additionally, Wall Street Funded provides all its clients with a thoughtfully designed trader dashboard that enhances risk management by offering continuous access to detailed statistics and goals. This guarantees timely updates, resulting in increased user satisfaction.

Wall Street Funded Trading Dashboard

Trustpilot Feedback

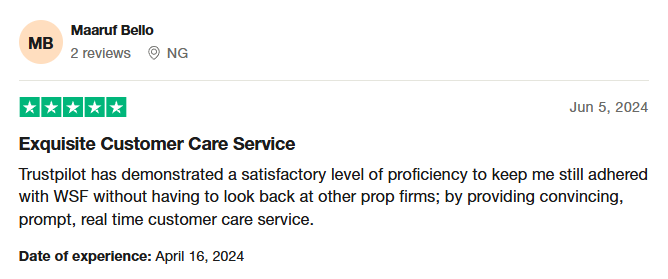

Wall Street Funded has gathered an excellent score on Trustpilot based on their community’s feedback.

On Trustpilot, Wall Street Funded has a large variety of their community commenting and providing positive feedback regarding their company services. The firm has achieved an impressive rating of 4.7 out of 5 from a substantial pool of 785 reviews. Notably, 85% of these reviews have awarded Wall Street Funded the highest rating of 5 stars.

The first client expressed a positive experience with Wall Street Funded, noting that Trustpilot reviews have reinforced their confidence in the firm. They appreciated Wall Street Funded’s convincing and prompt real-time customer care, which has kept them fully committed to this prop firm without needing to consider others.

The second client had a positive experience with Wall Street Funded, describing it as a reliable firm. They are currently on their second payout, which has consistently been received on time. The client also praised the effective communication with customer service, noting that any questions are promptly addressed. Having traded with several other firms, the client regards Wall Street Funded as one of their favorites and highly recommends it.

Social Media Statistics

Wall Street Funded can also be found on numerous social media platforms.

Customer Support

| Live Chat | ✅ |

| [email protected] | |

| Discord | Discord Link |

| Telegram | Telegram Link |

| FAQ | FAQ Link |

| Supported Languages | English, Spanish, French, Portuguese, Italian |

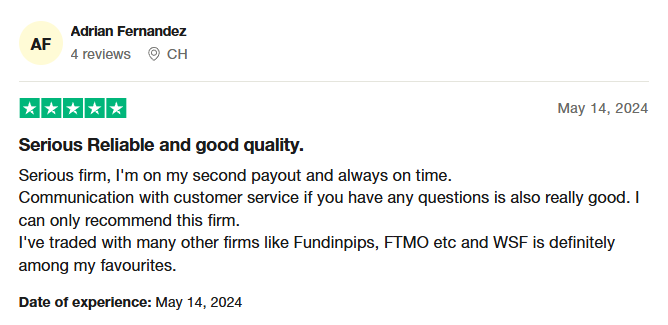

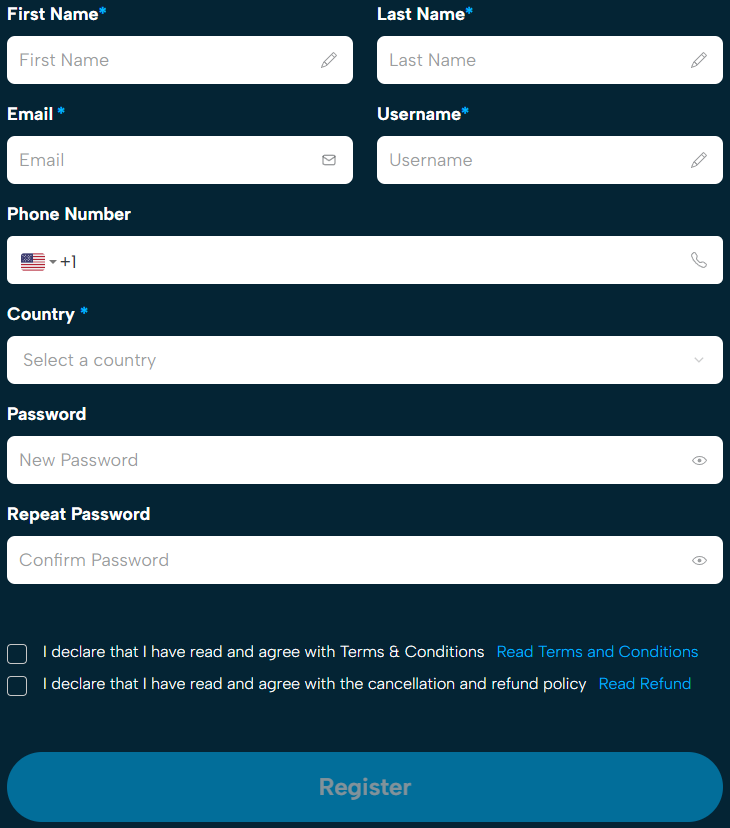

Account Opening Process

- Registration Form – Register with Wall Street Funded by filling out the registration form with your personal details and logging into the trading dashboard.

- Choose Your Account – Choose your account type, account size, trading platform, and add-ons.

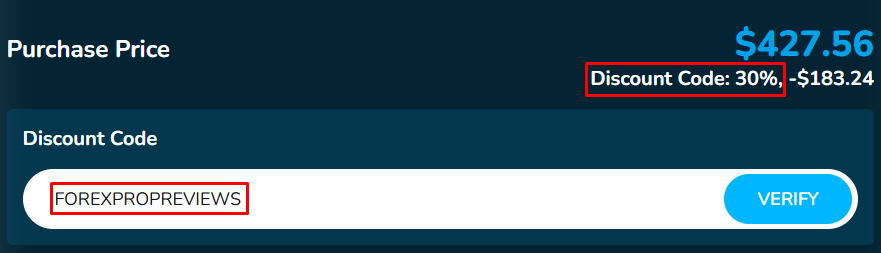

- Apply Discount Code – Apply our discount code FOREXPROPREVIEWS and enjoy a 30% discount on all Wall Street Funded account types.

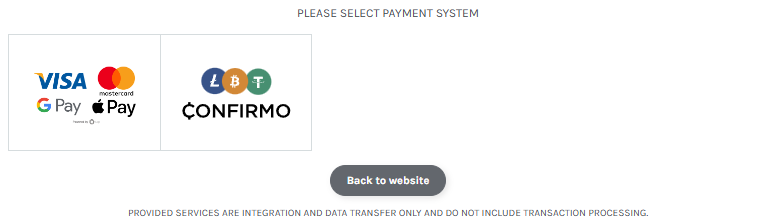

- Choose Your Payment Method – Choose between a credit/debit card and a cryptocurrency payment method. Additionally, for traders who reside in Argentina, Cameroon, Canada, Chile, Colombia, Cote D’Ivore, Educador, Ghana, India, Kenya, Mexico, Nigeria, Tanzania, Thailand, Uruguay, and Vietnam, Wall Street Funded offers AstroPay as a payment method.

Conclusion

In conclusion, Wall Street Funded is a reputable and trustworthy proprietary trading firm providing traders with an opportunity to choose between seven funding programs: the Classic Challenge and Ultra Challenge, which are two-step evaluations, the Rapid Challenge, which is a one-step evaluation, the Instant Standard and Instant Pro, which are an instant funding programs, and two crypto-oriented funding programs.

Wall Street Funded’s Classic Challenge is an industry-standard two-step evaluation that requires the completion of two phases before becoming eligible to manage a funded account and earn 80% up to 95% profit splits. Traders must reach profit targets of 8% in phase one and 5% in phase two to become successfully funded. These are realistic trading objectives, considering you have a 5% maximum daily and 8% maximum loss rules to follow. Regarding time limitations, you have no minimum or maximum trading day requirements during both evaluation phases, meaning that you can trade based on your preferred pace without any time pressure. Finally, it’s essential to note that the Classic Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

Wall Street Funded’s Ultra Challenge is an industry-standard two-step evaluation that requires the completion of two phases before becoming eligible to manage a funded account and earn 80% up to 95% profit splits. Traders must reach profit targets of 10% in phase one and 5% in phase two to become successfully funded. These are realistic trading objectives, considering you have a 5% maximum daily and 10% maximum loss rules to follow. Regarding time limitations, you have no minimum or maximum trading day requirements during both evaluation phases, meaning that you can trade based on your preferred pace without any time pressure. Finally, it’s essential to note that the Ultra Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

Wall Street Funded’s Rapid Challenge is a one-step evaluation that requires the completion of a single phase before becoming eligible to manage a funded account and earn 80% up to 95% profit splits. Traders must reach a profit target of 10% to become successfully funded. These are realistic trading objectives, considering you have a 4% maximum daily and 6% maximum loss rules to follow. Regarding time limitations, you have no minimum or maximum trading day requirements during the evaluation phase, meaning that you can trade based on your preferred pace without any time pressure. Finally, it’s essential to note that the Rapid Challenge features a scaling plan, providing you with the opportunity to increase your initial account balance.

Wall Street Funded’s Instant Standard is a direct funding account that allows traders to skip the evaluation altogether and start earning from the start. with a 3% maximum daily and 6% maximum trailing loss rules, which are realistic trading objectives. Regarding time limitations, you have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 4 calendar days. Finally, it’s essential to note that the Instant Standard features a scaling plan, providing you with the opportunity to increase your initial account balance.

Wall Street Funded’s Instant Pro is a direct funding account that allows traders to skip the evaluation altogether and start earning from the start. with a 3% maximum daily and 5% maximum trailing loss rules, which are realistic trading objectives. Regarding time limitations, you have no maximum trading day requirements during either evaluation phase. However, you are required to trade for a minimum of 4 calendar days. Finally, it’s essential to note that the Instant Pro features a scaling plan, providing you with the opportunity to increase your initial account balance.

I would recommend Wall Street Funded to individuals seeking a reputable proprietary trading firm that provides exceptional trading conditions catering to a diverse range of individuals with unique trading styles. They provide traders with unique features, such as an unlimited trading period, no minimum trading day requirements, add-on features, five unique trading platform choices, first withdrawal after 10 calendar days, 15 calendar days or 30 calendar days, and futures withdrawals on a 10-day basis. After considering everything Wall Street Funded has to offer to traders all across the globe, they can undoubtedly be regarded as one of the industry-leading prop firms.

Our detailed review of Wall Streat Funded was last updated on 04.02.2025 at 11:57 (CE(S)T).

What are your individual opinions on Wall Street Funded and the services they offer? Do they align with the trading conditions and services you’ve been seeking?

Let us know if you enjoyed our detailed Wall Street Funded review by commenting below!