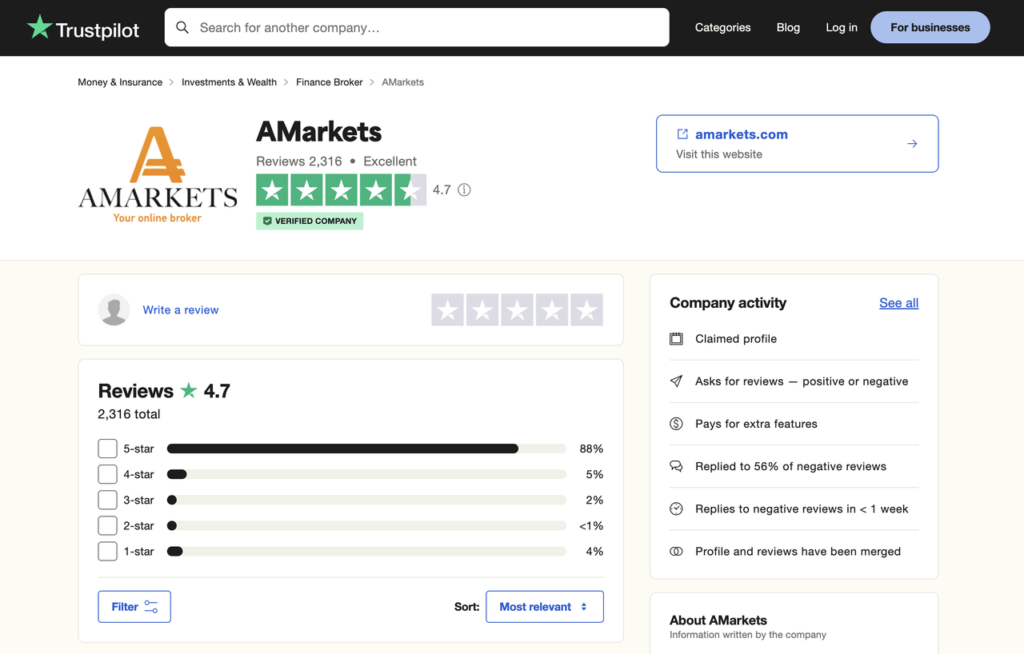

AMarkets Review

AMarkets is a well-established Forex and CFD broker that has been in operation since 2007. It offers a broad range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies, with high leverage options up to 1:3000. The broker supports three types of accounts: Standard, Fixed, and ECN, each tailored to different levels of experience and trading strategies. ECN accounts, in particular, are ideal for professionals due to their low spreads and direct market access.

Pros of AMarkets:

- Diverse Trading Platforms: AMarkets provides access to popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is particularly favored by both novice and advanced traders for its user-friendly interface and powerful trading tools. MT5, on the other hand, offers more advanced features, making it suitable for traders seeking enhanced functionalities such as advanced technical analysis tools and algorithmic trading options.

- Additionally, the broker offers a proprietary copy trading platform. This service allows less-experienced traders to mirror the trades of more successful traders, automating the process and potentially yielding profits without intensive market analysis.

- High Leverage: One of the standout features of AMarkets is its high leverage offering, which can go up to 1:3000 depending on the account type. While this provides the potential for larger profits with a smaller initial capital, it is essential for traders to manage the risks associated with high leverage.

- Low Spreads and Commissions: AMarkets’ ECN accounts feature low spreads starting from 0.0 pips and a competitive commission of $2.5 per lot per side. This can significantly reduce trading costs for active traders, particularly those trading large volumes. The Standard and Fixed accounts are commission-free, which can appeal to beginners who prioritize simplicity.

- Promotions and Bonuses: AMarkets offers various promotions, including deposit bonuses, cashback programs, and referral rewards. These incentives enhance the trading experience by providing additional capital or reduced costs, which can benefit both new and existing traders.

- Extensive Payment Options: The broker supports a wide range of deposit and withdrawal methods, including bank transfers, credit cards, and popular e-wallets like Skrill and Neteller. Cryptocurrency deposits are also accepted, offering flexibility for traders who prefer using digital currencies.

Cons of AMarkets:

- Offshore Regulation: While AMarkets is registered in offshore jurisdictions such as Saint Vincent and the Grenadines, Mwali (Comoros), and the Cook Islands, this may raise concerns for traders seeking brokers with stronger regulatory oversight from Tier-1 regulators like the FCA or CySEC. Offshore registration can offer flexibility, but it also means that regulatory protections may not be as robust as in other regions.

- Geographic Restrictions: AMarkets is not available to clients in certain countries, including the United States and the United Kingdom. This can be a limitation for traders based in these regions who are seeking access to its offerings.

- High Minimum Deposit for ECN Accounts: While the Standard and Fixed accounts require relatively low minimum deposits (starting at $100), the ECN account, which offers the best trading conditions, has a higher entry point of $200. This may be a barrier for some retail traders who are just starting out or have limited capital.

- Limited Educational Resources: Although AMarkets provides a range of analytical tools and market insights, its educational offerings for new traders are somewhat limited. While there are useful blog articles and a knowledge base, there is room for improvement in offering more structured, beginner-friendly trading courses or webinars.

AMarkets Account Types:

- Standard Account: Suitable for beginners, this account features floating spreads from 1.3 pips and no commissions. With a minimum deposit of $100 and leverage up to 1:3000, it’s designed for traders seeking simple, straightforward trading conditions.

- Fixed Account: This account offers fixed spreads starting from 3 pips, making it ideal for traders who prefer predictable costs regardless of market volatility. Like the Standard account, it requires a minimum deposit of $100 and offers high leverage.

- ECN Account: Tailored for professional traders, the ECN account provides the tightest spreads (starting from 0.0 pips) and the fastest order execution. It does, however, require a higher minimum deposit of $200 and includes a commission fee of $2.5 per lot per side.

AMarkets Regulation and Safety:

While AMarkets is regulated in offshore jurisdictions, it offers some security features, such as membership with the Financial Commission, which provides a compensation fund of up to €20,000 per client in the event of a dispute. This membership adds a layer of protection for traders, despite the broker’s offshore regulatory status.

Additionally, AMarkets has its order execution quality verified by independent third parties, which helps assure clients that their trades are executed at the best available prices with minimal slippage.

Customer Support:

AMarkets excels in customer service, offering 24/7 support via email, live chat, phone, and various messaging apps like Telegram and WhatsApp. Multilingual support is available, ensuring that clients from various regions can easily communicate with the support team. However, customer support is not available on weekends, which may be a drawback for traders who need assistance outside of regular business hours.

Conclusion:

AMarkets stands out as a solid broker for traders looking for high leverage, low spreads, and a broad range of trading instruments. Its offering of both MetaTrader platforms and a copy trading service caters to various types of traders, from beginners to experienced professionals. While its offshore regulation may be a concern for some, AMarkets compensates with excellent customer support, a wide array of payment methods, and attractive trading conditions, especially for those who can meet the higher deposit requirements for ECN accounts.

This broker is a strong contender for traders seeking flexibility and competitive trading costs but may not be the best fit for those prioritizing Tier-1 regulatory oversight or in-depth educational resources.