The Forex Funder Review: A Forex Trading Game Changer 📈

In the ever-evolving world of financial markets, traders are constantly seeking innovative platforms that provide opportunities for growth and success. The Forex Funder (TFF) is one such platform that has caught the attention of traders worldwide. Offering a unique approach to Forex trading, The Forex Funder empowers traders with remarkable benefits, promising a path to financial freedom. In this comprehensive review, we’ll explore the key features and offerings of The Forex Funder, shedding light on its distinct advantages in the Forex trading landscape.

Join the Global Trading Revolution: The Forex Funder’s Impressive Track Record

Join the Global Trading Revolution: The Forex Funder’s Impressive Track Record

The Forex Funder boasts a compelling track record in the competitive landscape of Forex trading. With a history of disbursing over $500,000 to traders and an astonishing 97.5% customer satisfaction rate, this platform is gaining the trust and recognition of traders worldwide. The platform’s impressive statistics indicate that it is indeed something special, worth investigating further.

Earn Money as a Seasoned Trader: Diverse Funding Options

Earn Money as a Seasoned Trader: Diverse Funding Options

Have you ever dreamt of securing up to $2.5 million in funding and claiming a remarkable 95% share of the initial profit split? If this sounds intriguing and new to you, this article will take you on a comprehensive journey through a company that extends this enticing offer. They allow you to trade with capital as high as $2.5 million and grant you an impressive 95% share of the profits generated from the funded account. The Forex Funder gives you the opportunity to do so.

These opportunities come in three different funding models: the One-Step Evaluation Model, the Two-Step Evaluation Model, and the Rapid Evaluation Model. We will delve deep into each of these models, exploring the unique benefits they offer. This will include an in-depth examination of the One-Step Evaluation Model, a detailed analysis of the Two-Step Evaluation Model, and a thorough overview of the Rapid Evaluation Model. By the end of this exploration, you will have a clear understanding of whether these funding models are the right fit for you and whether The Forex Funder is the ideal firm for your financial endeavors.

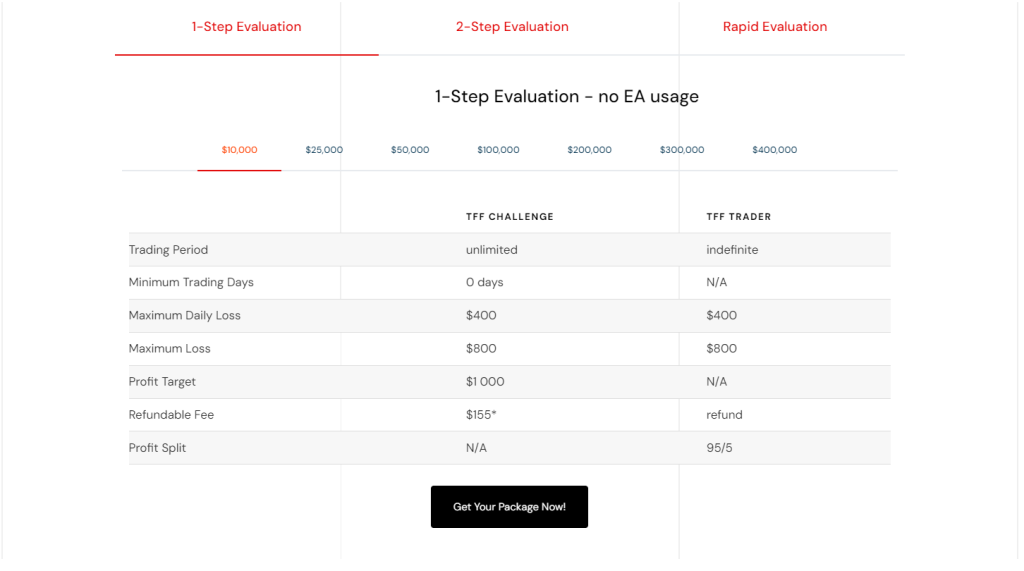

1 – Step Evalution

Key features of the One-Step Evaluation:

- Unlimited trading days requirement – No time limit restrictions

- Minimum trading days requirement is zero – You can complete the evaluation and move to the funded account on the same day

- Maximum daily loss limit is 4%

- Exceptional maximum overall loss limit of 8%

- Profit target is a consistent 10% across all accounts

- No minimum or maximum trading days limitations

- Refundable fee: $860 for the $100,000 account

After successfully completing the One-Step Evaluation, you’ll be eligible to receive 95% of the profit share from the funded account.

Important Note: The usage of expert advisors is not permitted in the funded account. Funded accounts are awarded after review, and only one step is required to access these opportunities.

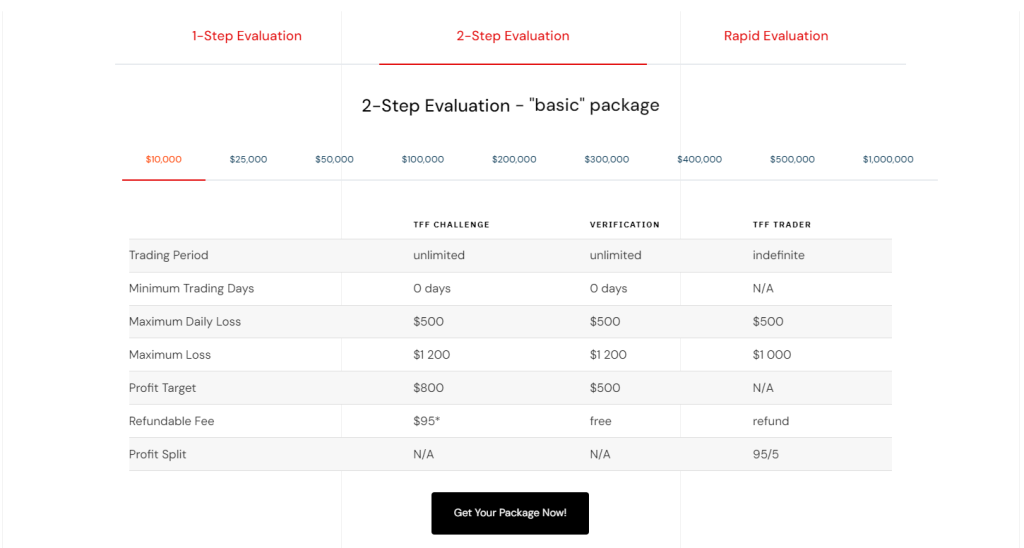

2 – Step Evalution

Key features of the Two-Step Evaluation:

- Unlimited trading days requirement in both phases

- No minimum trading days requirement

- Maximum daily loss limit is 5%

- Maximum overall loss limit is 12%

- Phase 1 profit target is 8%, equivalent to $8,000 on a $100,000 account

- Phase 2 profit target is 5%, equivalent to $5,000 on a $100,000 account

- Refundable fee: $539 before discount

After completing both phases of the Two-Step Evaluation, you’ll be awarded the funded account. Like with other evaluations, you’re eligible to receive 95% of the profit share from this funded account.

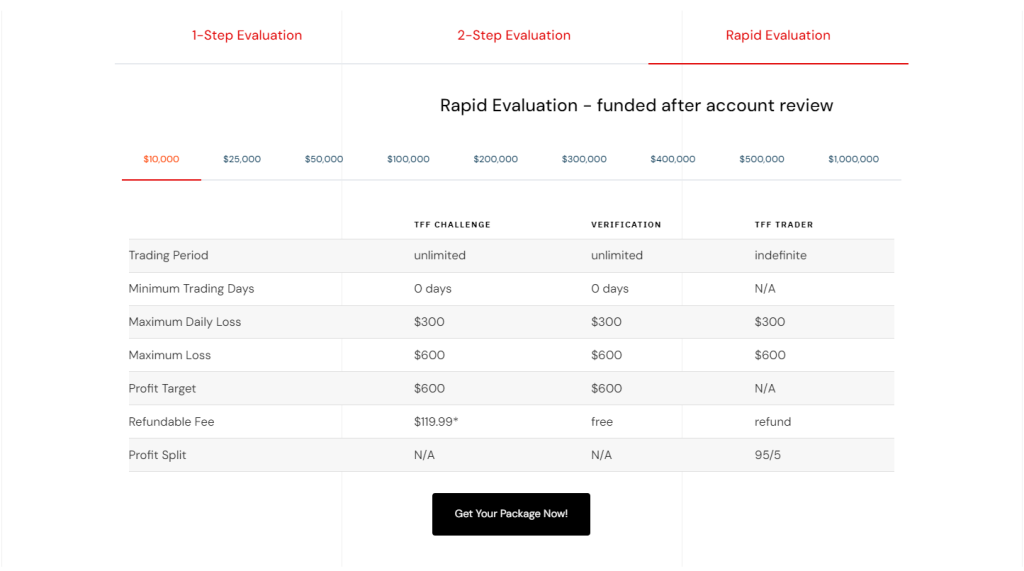

Rapid Evaluation

Key features of the Rapid Evaluation:

- Two-phase evaluation with unlimited trading days

- No minimum time restrictions

- Phase 1 profit target is 6%

- Phase 2 profit target is 6%

- 3% daily loss limit

- 6% overall loss limit

While the profit targets in Rapid Evaluation are lower compared to the Two-Step Evaluation, there is a trade-off. Rapid Evaluation comes with a daily loss limit of 3% and an overall loss limit of 6%, which is more restrictive.

While the Rapid Evaluation offers different profit targets and pricing, other aspects remain similar to the Two-Step Evaluation. The choice between the two models depends on your trading preferences and risk tolerance.

What makes The Forex Funder different from others?

Let’s compare The Forex Funder with another well-known program like the Funded Trader Program (FTMO). The Forex Funder offers some distinct advantages. They provide:

- Unlimited trading days

- No minimum trading days requirement

- Account sizes of $500,000 and $1 million at affordable prices

- Regulation in the United Kingdom, ensuring safety and compliance

- Partner broker: Think Markets, known for reliability

- Maximum capital holding of $2.5 million

- Leverage of 1:100 for challenge accounts

- Raw spreads with no commission or swap fees

- Eligibility for participants aged 18 and above, with a KYC process

One important requirement to note is that The Forex Funder mandates the use of stop-loss orders for every trade. This emphasis on risk management can be crucial for traders.

If you wish to merge your accounts, you can simply contact The Forex Funder via email to streamline your trading experience. The option to hold accounts up to $2.5 million, along with these features, positions The Forex Funder as a compelling choice for traders.

Conclusion

This review just gives a comprehensive understanding of The Forex Funder and the various evaluation models they offer. It’s essential to weigh your options and choose the one that best aligns with your trading goals and risk tolerance.

The Forex Funder Review – Final Thought

The Forex Funder is the real deal when it comes to prop trading firms. It’s a solid opportunity for beginners who want to boost their skills and be able to trade with more capital; as well as advanced traders who want to elevate their game without risking their own money. Funder has a fanbase funded traders that is growing rapidly. But here’s the thing: not everyone is accepted into The Forex Funder program.

Funder makes money when their traders make money, so it is in their best interest to find traders that can actually make money! You must apply and meet with a The Forex Funder Advisor to determine your eligibility. While this process is not time consuming, it is thorough enough to help them make the right decision.

So, if you are interested, click here to learn more about The Forex Funder

REFERENCES ARTICLE

The Truth About Trade TIME Floor Scams

The development of the Internet has opened up a new playing field for investors. With more than 300 Forex brokers, international stock exchanges in the market…

Top 3 Prestigious Forex Platforms For Porsche IPO Investments

Porsche predicts the IPO value will reach $70 billion. Therefore, it can be said that this is the right time for investors to pour capital into…

HiBiMarkets Review From A To Z

HIBIMARKETS Trading Platform Overview Founded in 2005, HibiMarkets is a licensed and regulated Forex and CFD online broker on…

Should You Evaluate Macro Equities Floors Before Investing?

If you are a forex player or intend to invest, you will definitely know about the Macro Equities trading platform. Talking about the exchange…

DBay Exchange – Vietnam’s Leading Crypto Exchange

DBay crypto exchange is one of the trading partners chosen by Vietnamese investors to experience and positively evaluate….

All You Need To Know About BCR . Flooring

BCR Broker Website: www.bcrcorp.com.au Leverage: 1:400 Managed by: ASIC Min Deposit: 300 USD Headquarter: Australia Trading Platform: BCR Trader,…

Scam Warning: Bold Prime Exchange Is Not Safe

The Forex market developed strongly, many brokers were born to serve the diverse needs of traders. Why is Bold Prime floor being…

First Option: What’s Attractive About Emerging Exchanges

As a newcomer to the market, First Option – a broker that has received positive feedback from experts. The content of this post…